And she comes from another program that charges any. RateSetter is helping to reverse that trend and our book of loans to SMEs is growing strongly – business loans make up £137m of our outstanding loan book. // JJ funded her first deal and made commissions right after she signed up to Business Lending Blueprint. “In recent years banks have pulled the shutters down firmly on lending to small businesses. Rhydian Lewis, Founder and CEO of the platform, offered his thoughts: At first it was intimidating with all the information that was available. The BBB’s stamp of approval will likely also serve to quell any concerns over the “quality” of RateSetter's suddenly accelerated commercial lending activities. Sammy Sapien said 'Joining the Business Lending Blueprint has been one of the best investments ive ever made in my life. Best for: Average every day people, home business enthusiasts, finance enthusiasts entrepreneurs, and many more. Though the Bank hasn’t publicly committed to lending further amounts via the platform, the inclusion of SME debt might well serve as a blueprint for future RateSetter cooperation. Product Type: Small Business Loan Service Partner Program.

BUSINESS LENDING BLUEPRINT BBB PLUS

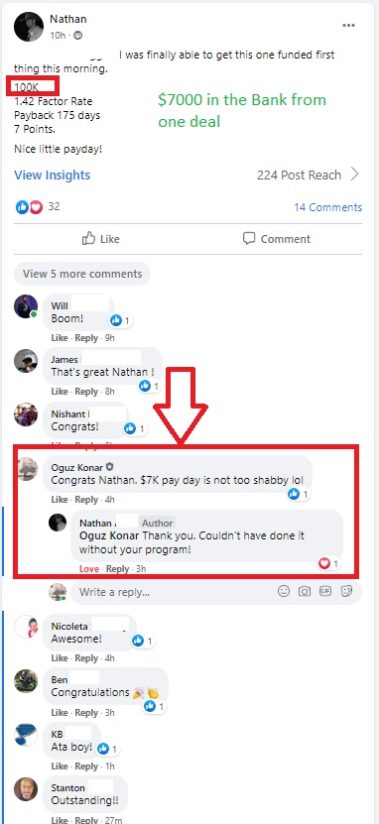

There isn’t a huge amount of the BBB’s initial £10m left – just £2m of the original amount, plus any repayments to date – but part of what there is will be allocated to SME loans. Heres a look at everything you get: 6 training. Oz claims you can earn 10k+ per month by following his blueprint. The Business Lending Blueprint is the training that teaches you about alternative lending.

The platform has experienced a 60% year-on-year increase in SME lending over the past 3 months. Business Lending Blueprint is a program taught by Oz Konar which aims to help people achieve financial freedom by becoming the middlemen on creative financing solutions for business owners. That’s £180m of RateSetter money that has been allocated to “commercial” loans (including £43m in property loans), as distinct from consumer loans. RateSetter recently revealed that a whopping 40% of its outstanding loans belong to businesses of some description. What classes as “qualifying” now includes SME loans. £10m was then to be put to work, which would comprise 40% of any qualifying loan until £4m of the money was used up, after which point the remaining funds would make up 20% of all qualifying loans. The BBB first began pumping money through the RateSetter platform in July 2014, with the express purpose of providing funding to sole traders.

0 kommentar(er)

0 kommentar(er)